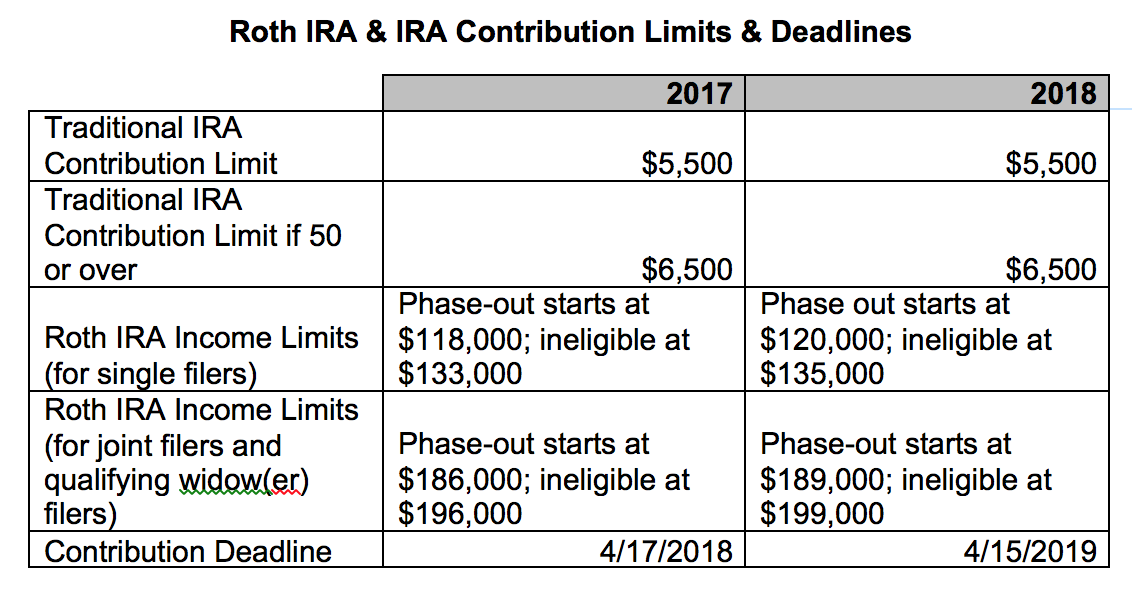

The April tax filing deadline is quickly approaching – and along with it IRA contribution deadlines. The tax savings from making an IRA contribution can be substantial. Below is a quick breakdown of the IRA deadlines, limits and provisions.*

You must have earned income to contribute to

WHY IS CONTRIBUTING TO AN IRA IMPORTANT?

The traditional IRA is helpful if you need to reduce your adjusted gross income to a lower tax bracket. For example, if a single person has a modified adjusted gross income of $50,000 a year and contributes $5,500 to a traditional IRA, then he can take a $5,500 tax deduction. If you are under the maximum income limits for a Roth IRA, this is an even better investment vehicle. If eligible, Roth IRAs allow you to contribute after-tax dollars to receive tax-free growth from these investments when you take a distribution.**

The power of compound interest makes it beneficial to invest each pay period to either type of IRA. At Financial Plans & Strategies, we offer automatic investing with no minimum investment limits so you never miss a contribution. Most of our clients simply plan on money coming out of their accounts and don’t notice a difference in lifestyle.

Additionally, there are other ways to contribute to your retirement. One of these ways is through a lump sum contribution – did you get a refund on taxes or a bonus at work? Think about investing this for your future instead of short-term spending.

Retirement is closer than you think and the IRA contribution deadline is even closer. Call Financial Plans at 317-882-7675 to set up your automatic contributions today.

----------

* Please note: We are not a tax advisory firm and do not give tax advice. If you have additional questions, please speak with your tax advisor. If you do not have a tax advisor, we are happy to give you a referral. Financial Plans & Strategies does not receive any compensation for tax advisor referrals.

** To receive this benefit, your distribution must be considered “qualified” by the IRS.

- Your IRA contribution may be tax deductible if your income is below allowable limits and you are not covered by an employer plan at work. https://www.irs.gov/retirement-plans/ira- deduction-limits

- Roth IRA distributions are not taxable as ordinary income if you have held the IRA for at least 5 years

- IRA – You must be at least age 59 ½ to avoid 10% early withdrawal tax penalty. Certain exceptions apply. https://www.irs.gov/retirement-plans/plan- participant-employee/retirement- topics-tax- on-early- distributions

- Because you have already paid taxes on contributions to your Roth IRA, you can take this portion out at any time without taxes or penalties. For anything above this amount, you must be at least 59 ½ and have held the account for 5 years.

- For contributions to your IRA, there are no income limits to restrict your contribution eligibility. However, you may not be able to deduct your contribution for tax purposes.

- At 70 ½ you are no longer eligible to contribute to a Traditional IRA. At this time the IRS requires that you begin taking required minimum distributions (RMDs) from this account.